Renters Insurance in and around Milton

Looking for renters insurance in Milton?

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

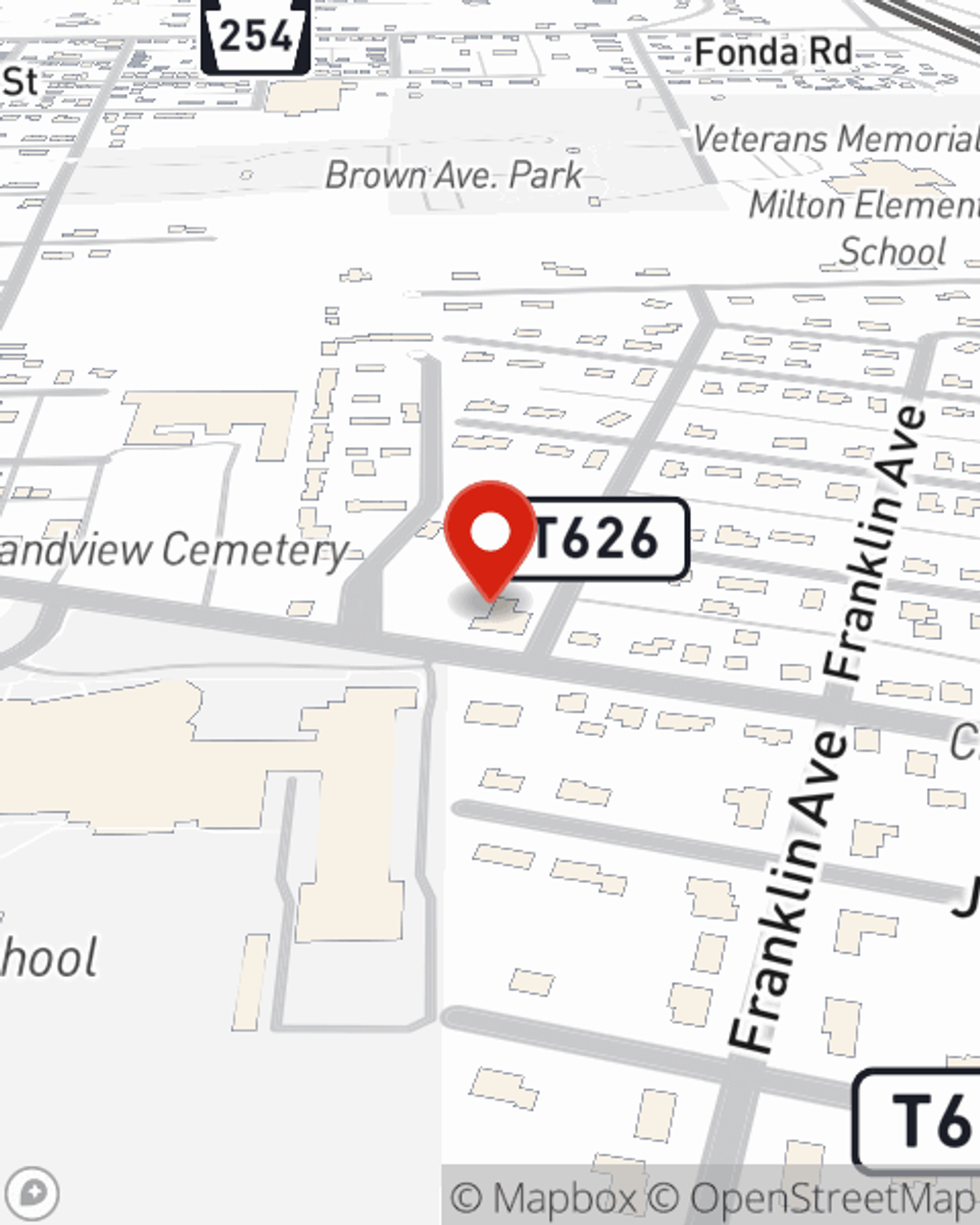

- Milton

- Lewisburg

- New Columbia

- Muncy

Insure What You Own While You Lease A Home

Think about all the stuff you own, from your entertainment center to bed to sports equipment to lamp. It adds up! These personal items could need protection too. For renters insurance with State Farm, you've come to the right place.

Looking for renters insurance in Milton?

Your belongings say p-lease and thank you to renters insurance

Protect Your Home Sweet Rental Home

When renting makes the most sense for you, State Farm can help protect what you do own. State Farm agent Matt Frye can help you with a plan for when the unexpected, like a fire or an accident, affects your personal belongings.

There's no better time than the present! Get in touch with Matt Frye's office today to see how helpful renters insurance can be.

Have More Questions About Renters Insurance?

Call Matt at (570) 742-8501 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.